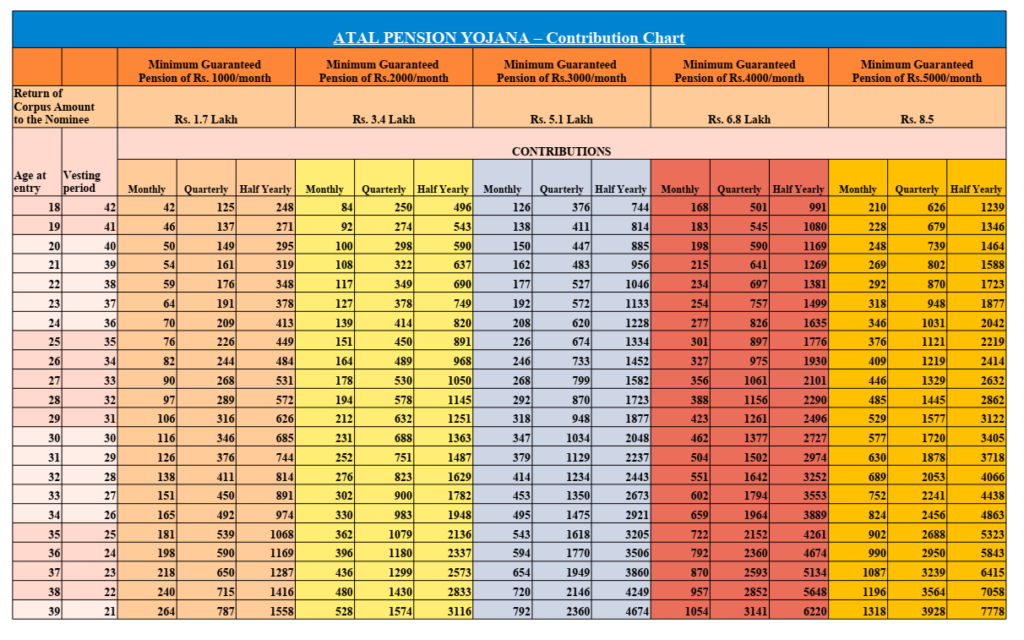

PM Modi-led government launched the Atal Pension Yojana Scheme for Indian citizens on 9 May 2015. This scheme allows Indians to contribute to their Atal pension Yojana account until they are 60 and get a monthly pension. This is essential for the financial security of unorganized sector workers in their old age, and for their well-being. The pension may vary according to your contributions, ranging from Rs.1000 to Rs.5000.

To avail of this scheme, the age limit is 18-40 years ie. one must at least contribute for 20 years in this scheme. In addition, he should have a savings bank account at either a post office or a savings bank.

Contribution Chart of Atal Pension Yojana

Some benefits of this scheme are:

Retirement Benefits

Primally the Atal Pension Yojana grants several benefits, but it is mainly noted for its retirement benefit. According to the contribution amount, the monthly pensions range from Rs 1,000 to Rs 5,000 with different contribution amounts for these pensions. In case of the death of the subscriber, a pension is paid to the spouse.

Tax Benefits

To motivate Indian people regarding investment in Atal Pension Yojana, the APY scheme subscribers can avail of tax benefits under the National Pension System (NPS) scheme.

Death Benefits

These benefits first go to the spouse of the Atal Pension Yojana beneficiary in the event of the death of a Pension contributor. It is also worth noting that in case there is only one contributor, in the event of his demise, the pension accrues automatically to the surviving spouse, who is the default nominee for the deceased contributor. In case both the contributor and spouse are deceased, then the nominee gets the corpus amount defined for that slab of pension. When there is a death before the age of 60 years, the spouse has an option of continuing the Atal Pension Yojana account to receive benefits under it or closing the account and receiving the contributions and the gains on it.

So, it is advisable to contribute to the Atal Pension Yojana Scheme to ensure sufficient pension benefits later on.